Mortgage Payment Options

Pay Online

You can schedule a One-Time ACH electronic payment from a checking or savings account.

Payment is processed through a secure online site*. Payment will be verified prior to processing. Please allow up to 48 hours for processing.

Florida Capital Bank does not offer the ability to set up automatic monthly payments. Making a payment online does not create a FLCBank online bank account.

Pay by Phone

866.295.0014

extension 1600

Monday - Friday

9:00am - 5:00pm (EST)

We do not accept credit cards as payment.

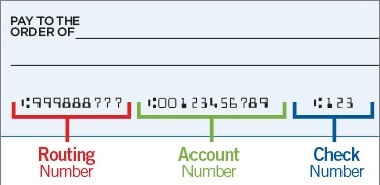

To pay by phone you will need to provide your bank routing number and checking or savings account number.

Pay by Mail

Please plan according if sending payment through postal mail. USPS delivery times can be between 4-7 business days.

To pay by check or money order please send payment to:

Florida Capital Bank, N.A.

Attn: Mortgage Payment

P.O. Box 551390

Jacksonville, Fl 32256-1390

We recommend following up with FLCBank to confirm receipt of payment due to the increase in mail theft and check fraud.

Partial payments will not be accepted. Any amount paid over your regular payment amount will be applied towards the principal balance.

*The Pay Online link will bring you to a third-party website, owned and operated by an independent party. Any link you make to or from the third-party website will be at your own risk. Any use of the third-party website will be subject to and any information you provide will be governed by the terms of the third-party website, including those relating to confidentiality, data privacy, and security.

Lenders sometimes transfer mortgage loans. How and why do they do this?

More importantly, what does it mean for homeowners?

Mortgage transfers by lenders are quite common. The good news for borrowers is that mortgage transfers do not affect the terms of their loans. The only difference is likely to be where you send your monthly payments.

If the lender who originated a loan, and whose name appears on the loan paperwork, transfers the loan to someone else, the interest rate, repayment period, and other terms of the loan remain unchanged. If the loan has an adjustable rate, the new lender cannot adjust more than whatever the loan agreement allows. Many lenders use third-party companies known as loan servicers to handle the receipt of payments.

If you have any questions about your mortgage payment contact our payment services department at 866.295.0014, extension 1600 (Monday-Friday 9AM - 5PM Eastern) or contact us form.