What should business owners do to grow the value of their business? Most advice favors increasing sales and enhancing profits. Instead, business owners should strive to get the business viewed as a low risk, highly desirable investment opportunity. Every lender, investor or buyer looks at a business differently; however, the one factor that trumps all others is how much perceived risk is inherent in the business.

“De-risking” the business should be an owner’s number one priority. A low-risk profile helps position the business as an attractive investment opportunity and increases value. Too much risk can cause a lender, investor or buyer to reject an opportunity. Generally speaking, there is an inverse relationship between risk and quality. The higher perceived risk in a business, the lower its quality. Now, the question is, “Where does the risk come from, can it be quantified and controlled, and how does it relate to value?”

Investment and valuation professionals review all of the following areas of a company: planning, leadership, sales, marketing, people, operations, finance and legal. Some investment models take these eight broad categories and break them down into multiple subcategories. All these categories contain elements of risk-every one of which can be benchmarked against a set of private company best practices. Some are solely under the control of the owner, and some are not. It’s this benchmarking process that connects the risk profile to valuation and investment quality. While there are several ways to establish the value of a privately held business, professional investors and buyers will assign the level of perceived risk to the cost of capital (discount rate) in a projected Discounted Cash Flow (DCF) and terminal value analysis. The higher the risk in the business, the greater the cost of capital or discount rate will be.

Private equity firms use a hurdle rate that is derived from their commitments to their funding partners to establish a valuation and then try to assess the chances of achieving that return. No matter what approach is employed, perceived risk is a major consideration in the valuation process.

So, how does an owner go about “de-risking” their business? It starts with a comprehensive and objective assessment of where the business stands relative to companies that perform best in class. From this assessment, a complete risk and quality profile can be developed and tied to a cost of capital or discount rate to establish the intrinsic value for the business. Areas, where there is considerable risk that can easily be fixed, should be addressed first. Other areas that take longer to enhance can be planned over time. The whole process can take as long as one to three years to reach a high level of performance and low state of risk, but the effort can reap huge benefits in terms of increased value.

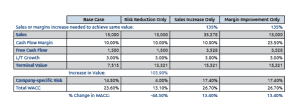

Illustrated in the table below is a company with $15 million in sales and 10% cash flow margin. Assume the Company Specific Risk, a risk that can be controlled, is 14.5% and the total Weighted Average Cost of Capital (WACC) is 23.6%. (This is the discount rate that will be applied to normalized cash flow.) The terminal value of this business with a 3% long-term growth rate is indicated in the table below. A plan can be developed, along with an advisor that focuses on risk reduction, lowering controllable risk (company-specific risk) down to 4%, which results in a decline in WACC to 13.1%. Accomplishing this could double the value of the business as illustrated in the table below. To get the same increase in value the business would need to grow sales by 135%, (a high-risk strategy) or improve margins by a like percentage. Either of these scenarios has the potential to increase company risk levels in the process, which could dilute the expected growth in value.

Illustrated in the table below is a company with $15 million in sales and 10% cash flow margin.

(Please see downloadable PDF for complete chart)

Assume the Company Specific Risk, risk that can be controlled, is 14.5% and the total Weighted Average Cost of Capital (WACC) is 23.6%. (This is the discount rate that will be applied to normalized cash flow.) The terminal value of this business with a 3% long term growth rate is indicated in the table below. A plan can be developed, along with an advisor that focuses on risk reduction, lowering controllable risk (company specific risk) down to 4%, which results in a decline in WACC to 13.1%.

Accomplishing this could double the value of the business as illustrated. To get the same increase in value the business would need to grow sales by 135%, (a high risk strategy) or improve margins by a like percentage. Either of these scenarios have the potential to increase company risk levels in the process, which could dilute the expected growth in value.

Perceived risk is a critical component of a lender’s, investor’s or a buyer’s assessment of an opportunity. Attempting to significantly increase sales, or expand margins, without first reducing risk will likely increase risk and decrease the value. Combining a risk-reduction program, as a first step, with subsequent strategies to increase sales and expand margins will drive a favorable impact on value due to a lower discount rate applied to higher cash flow. This value enhancement can be done without necessarily increasing equipment needs, staffing, working capital, etc.

Through a structured process, a solid financial model, and an independent assessment, the value of a business could be increased significantly. However, it takes time, a commitment from the shareholders and management team, as well as the right advisors to implement.